California Declaration Homestead Form Joint Which to Use

Ownership of property can take many forms. The recording of a homestead declaration has no effect on.

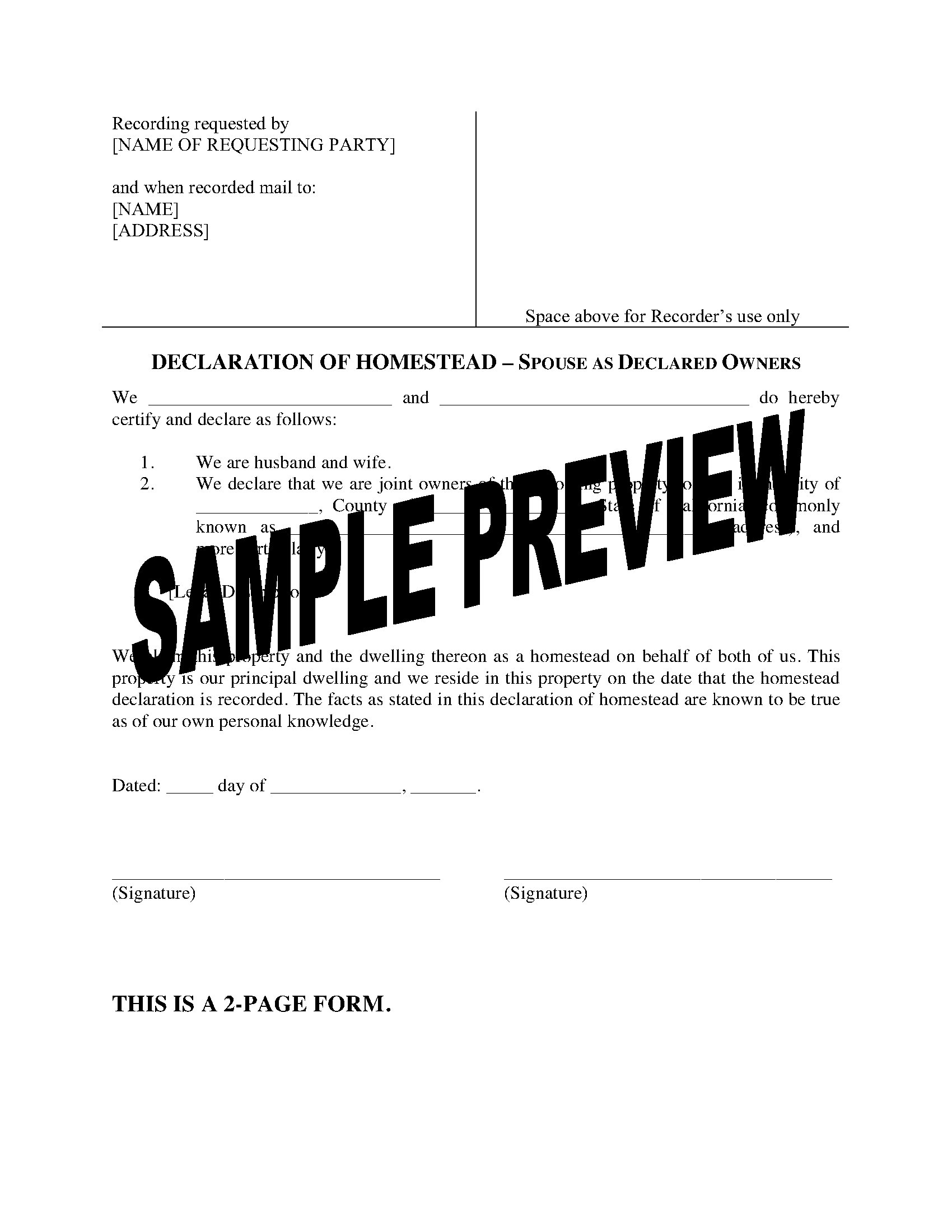

California Homestead Declaration Form For Spouses Legal Forms And Business Templates Megadox Com

Useful when changing residences as only one homestead is permitted under California law.

. In Californias System 2 homeowners can exempt up to 31950 of home equity. This property is our principal dwelling and we actually reside in this property on the date that the homestead declaration is recorded. A single person homestead exemption.

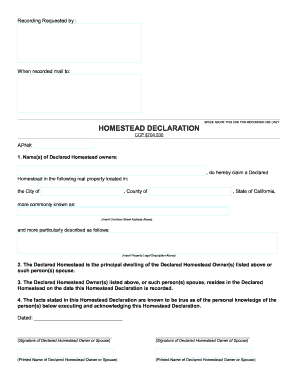

We own the following interest in the above declared homestead. How to perform a Homestead Declaration 0 Homestead Form California on the web. Additional language is required by law if it is executed by a guardian or conservator of the person or the estate of a declared homestead owner or a person acting under a power of attorney or otherwise authorized to act for a declared homestead owner or spouse.

Record the Homestead Declaration. Ad Get Access to the Largest Online Library of Legal Forms for Any State. California Declaration of Homestead.

Fill in the type and date of the deed and the book page number and date it was recorded. A homestead in the California homestead exemption codes means a persons home. Write your name county and street address.

Use the particular hints in order to complete the relevant fields. The PDF file is an interactive computer fill-in form traditional appearance. The last changes reflected in this article occurred on April 1 2022.

Check whether you filed for homestead exemption last year. Make certain you enter right information as. The California Judicial Council updates the amounts every three years.

Up to 25 cash back In Californias System 1 homeowners can exempt up to 600000 of equity in a house. Collection agencies should consult an attorney on the need for filing a homestead declaration. The principal dwelling of my spouse strike inapplicable clause I am currently residing on that declared homestead.

The rationale of the law in California is that the family home is vital for the continued healthy function of the family and unless it is a very expensive home with great equity the Courts are instructed to protect this asset so that the debtor will at least have a home for the family or him or herself. Give complete legal description 3 We claim this property and the dwelling thereon as a homestead on behalf of both of us. Fill in the parcel ID number or legal description.

If you own and live in a house condo mobile home or boat it. This property is our principal dwelling and we actually reside on this property on the date that the homestead declaration is recorded. California and more particularly described as follows.

4 The above declared homestead is strike inapplicable clause my principal dwelling and. CCP 703140 b 1. The policy underlying homestead laws is to provide a place for the family where they may live free from the anxiety that it may be taken.

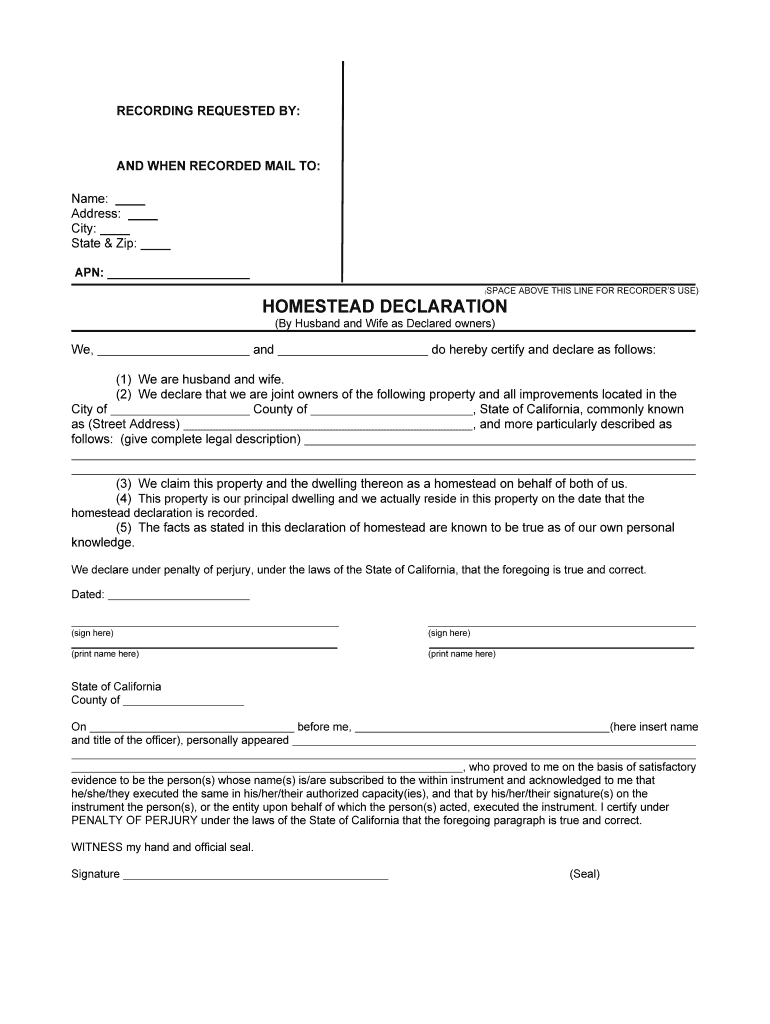

Very broadly real property may be owned in the. The Homestead Declaration must be notarized and then filed in the Recorders Office of the county in which the property is located. However there are limitations and exceptions.

The facts as stated in this declaration of homestead are known to be true as our own personal knowledge. My spouse is 5 The facts stated in this Declaration are true as of my personal knowledge. In California the Declaration of Homestead pertains to property located anywhere in the state and is not limited to deed-restricted property and homeowners associations.

950 Declaration of Abandonment of Declared Homestead Recordable form to abandon a prior recorded declared homestead. Give a complete legal description We claim this property and the dwelling thereon as a homestead on behalf of both of us. The homestead exemption gives you rights against many debts you might incur through accident illness or misfortune.

EFFECTS OF THE HOMESTEAD DECLARATION The first effect of the declaration is the information described above namely the exemption from judgment. We declare that we are joint owners of the following property located in the City of _____ State of California commonly known as street address. One of the first.

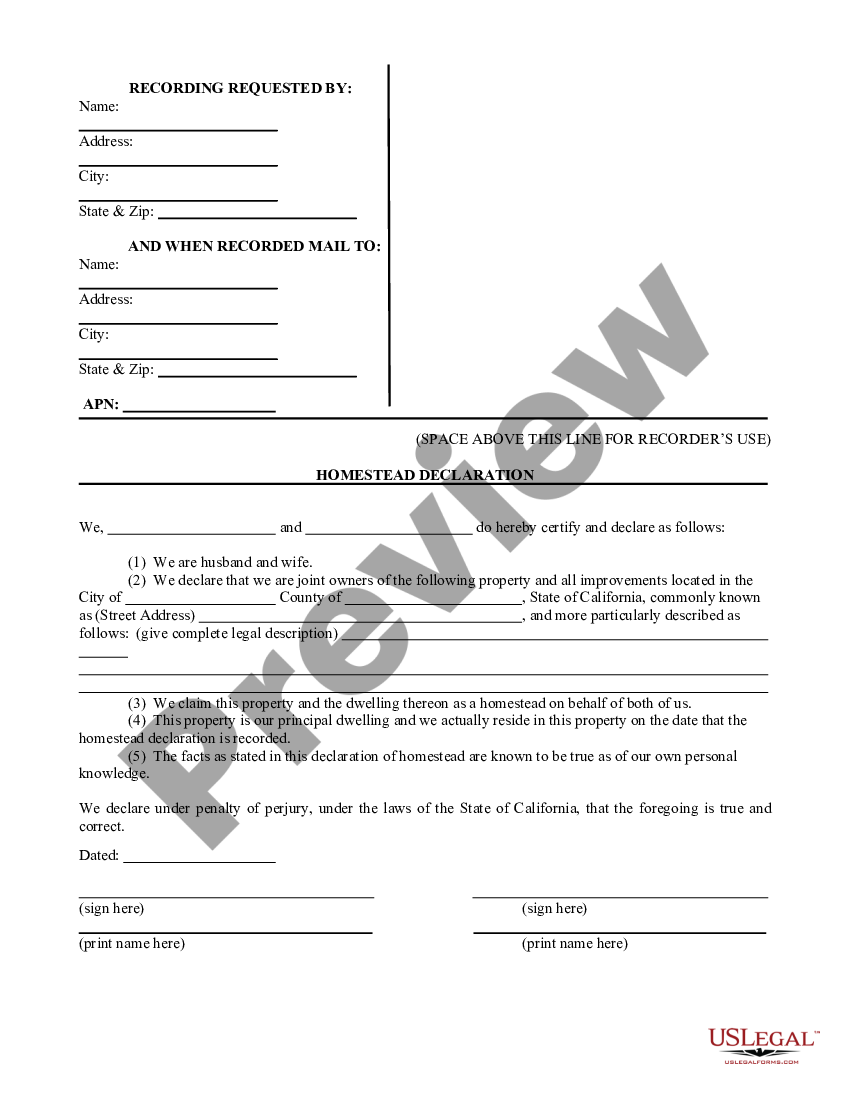

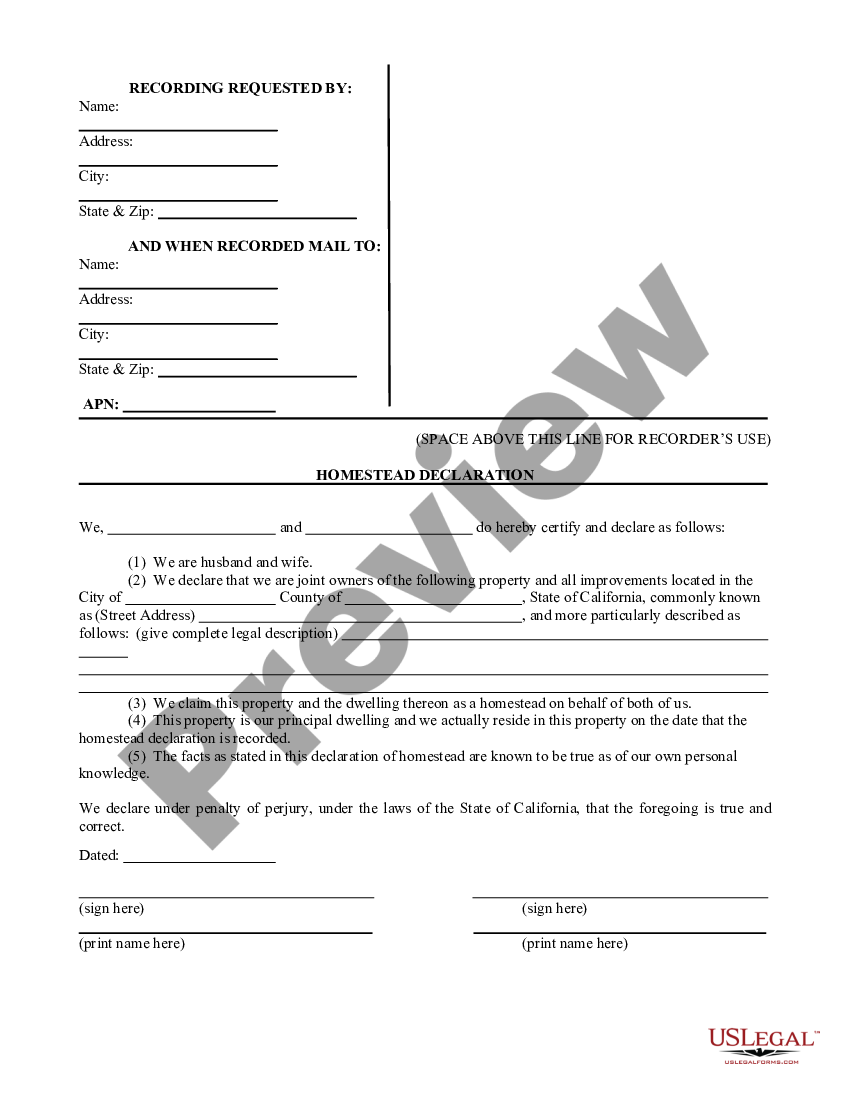

2 We declare that we are joint owners of the following property and all improvements located in the City of County of State of California commonly known as Street Address and more particularly described as follows. The Homestead Declaration is a form asking you to confirm you own the home and that it is your primary residence and current dwelling. On the web site with the document simply click Begin immediately as well as complete on the publisher.

Highest exemption applies to homeowners who are 65 years of age and older disabled persons and persons between 55 and 65 years of age if their annual. California was admitted to the Union by the United States on September 9 1850. The form of ownership is usually selected based on the needs of the owner or owners.

Long property descriptions will need to. Filing the Declaration with the County Recorder creates what is called a declared homestead. The declaration MUST be filed by the homeowner prior to the recording of the judgment lien by the creditor.

The facts stated in this. A declared homestead protects your home from voluntary andor forced sale. We claim this property as the dwelling thereon as a homestead on behalf of both of us.

Homestead Declaration-Spouses Abandonment of Declared Homestead Sample filled-in forms with instructions are available at the end of this Guide. Fill in your county and the tax year. If you are a single person who owns a home in California you should protect yourself against sale by creditors with this Homestead Declaration form.

Homestead Declaration is recorded. Income does not exceed 15000 or 20000 if married but. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

The above homestead is strike inapplicable clause my principal dwelling the principal dwelling of my spouse and strike inapplicable clause I am my spouse is currently residing on the declared homestead. Include your own personal info and contact info. Assuming a creditor wishes to foreclose.

This form is designed to be executed by a declared homestead owner or spouse.

Homestead Declaration For Husband And Wife Form Online Sellmyforms

California Homestead Declaration For Husband And Wife Homestead Declaration Form California Us Legal Forms

Homestead Declaration Form Kern County California Fill And Sign Printable Template Online Us Legal Forms

Homestead Form California Fill Out And Sign Printable Pdf Template Signnow

Comments

Post a Comment